Position Sizing on Polymarket and Kalshi Crypto Up/Down Predictions

Prediction Markets Crypto 15min up/down Polymarket/Kalshi Position Sizing: Kelly

Why Most Crypto Traders Lose Even When They’re “Right”

Most Polymarket and Kalshi traders don’t lose because they always pick the wrong side.

They lose because they bet the wrong size.

I see this mistake every day — especially in crypto UP/DOWN markets on Polymarket and Kalshi.

Let me show you how it happens, why it feels unfair, and how professionals approach position sizing very differently.

The Most Common Polymarket/Kalshi Crypto Prediction Market Mistake

Here’s what most traders do:

-

See Bitcoin at 50 / 50 odds

-

Think: “Looks fair”

-

Bet 5% of their bankroll

-

Repeat this across many markets

-

Slowly wonder why their account is bleeding

After 20 losses, they’re frustrated.

After 50 trades, they’re broke.

And they don’t understand why — because it feels like bad luck.

It isn’t.

It’s math.

Why This Is Normal (Even If It Feels Terrible)

At 50/50 odds:

-

losing streaks are expected

-

variance is brutal

-

bankroll swings are huge

Betting 5% per trade on coin-flips is financial suicide, even if you’re slightly better than random.

Probability doesn’t care how confident you feel.

Professionals Think in Edge, Not Direction

This is where the mindset shifts.

Pros don’t ask:

“Is Bitcoin going UP or DOWN?”

They ask:

“Do I have an edge — and how big is it?”

And if the edge is small (which it almost always is), they size accordingly.

The Kelly Criterion (In Plain English)

This is where most retail traders stop reading — but don’t.

The idea is simple.

Kelly tells you:

how much of your bankroll to risk based on your edge

The simplified formula looks like this:

f* = (P_true − P_market) / (1 − P_market)

You don’t need to memorize it.

You just need to understand what it means.

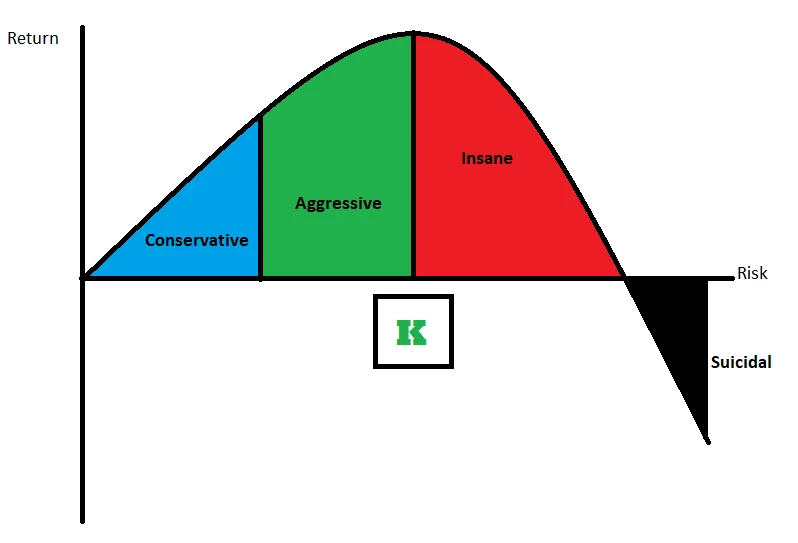

Kelly Position Sizing Chart

Simple Example: 15-Minute BTC Up/Down Crypto Predictions Market

Let’s say you’re trading Bitcoin UP/DOWN.

-

Market odds: UP at 50¢ → 50%

-

Your analysis: UP is actually 54%

-

Your edge: 4%

Most traders do this:

-

“I like UP”

-

Bet 5–10%

Kelly says:

-

Risk ~2.1% of your bankroll

Not 5%.

Not vibes.

2.1%.

Why?

Because that’s the size that:

-

maximizes long-term growth

-

minimizes risk of ruin

-

survives losing streaks

Why This Feels Counterintuitive

Retail traders want:

-

fast gains

-

excitement

-

“conviction trades”

Professionals want:

-

compounding

-

survival

-

consistency

Big bets feel powerful.

Small optimal bets feel boring.

Boring wins.

Real Polymarket/Kalshi Example (15-Minute BTC Up/Down)

Here’s a real-world style setup you see often:

-

Market odds: BTC UP at 52¢

-

Your research: 56% probability

-

Edge: 4%

Kelly says:

-

Position size: ~1.8% of bankroll

Expected value:

-

+0.072% per trade

That sounds tiny.

But over:

-

50 trades → +3.6%

-

200 trades → +14–15%

With controlled risk.

That’s how professionals grow accounts.

Why Most Traders Ignore This (and Lose)

Because:

-

sizing isn’t exciting

-

math isn’t sexy

-

small edges don’t feel powerful

So instead:

-

they oversize

-

they chase

-

they tilt after losses

-

they abandon strategies that were actually positive EV

91% of Polymarket traders lose not because they can’t predict — but because they don’t size.

Polymarket vs Kalshi: Position Sizing Matters on Both

This applies to:

-

Polymarket 15-minute UP/DOWN markets

-

Kalshi hourly crypto markets

The structure changes, but the rule doesn’t:

Edge × Optimal Size = Long-term survival

Shorter timeframes just punish bad sizing faster.

The Hard Part: Knowing Your True Probability

Everything above depends on one thing:

knowing P_true.

And that’s where most traders guess.

They:

-

eyeball charts

-

follow Twitter sentiment

-

assume “50/50” means fair

That’s a mistake.

Where the Right Tools Matter

Crypto is one of the few markets where:

-

massive data exists

-

short-term structure repeats

-

probabilities can be estimated systematically

Tools that analyze:

-

historical distributions

-

short-term returns

-

volatility regimes

can help you spot small but real probability differences.

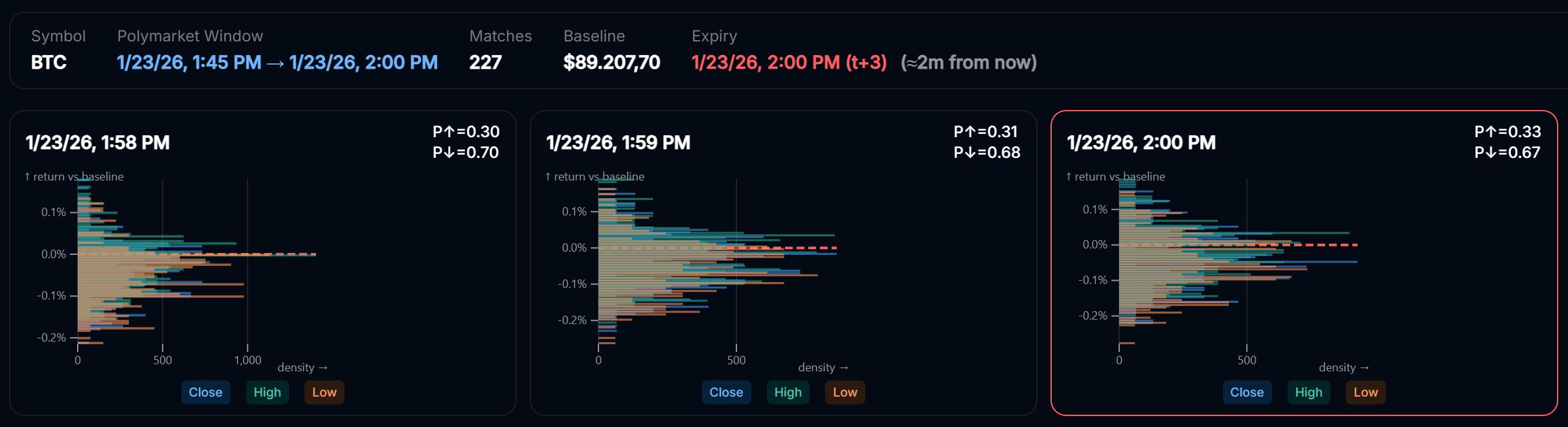

This kind of view makes it obvious when:

-

market odds don’t match reality

-

probabilities drift late in the interval

-

edge exists — or doesn’t

How Crypticorn Fits Into This

At https://www.crypticorn.com/up-down-crypto-predictions-15min-1h-4h-daily/https://www.crypticorn.com/ we focus on one thing:

👉 Estimating real UP/DOWN probabilities for short-term crypto markets

Not trading for you.

Not placing bets.

Not promising certainty.

Prediction Markets Crypto Up/Down Probabilities Charts AI Tool

Just helping you answer:

-

Is this really 50/50?

-

Or is it 54/46?

-

And therefore: how big should I bet?

That’s where position sizing finally makes sense.

Final Takeaway on Position Sizing with Crypto Prediction Markets

Most Polymarket and Kalshi traders don’t lose because they’re wrong.

They lose because:

-

they bet too big

-

on tiny edges

-

too often

The edge isn’t predicting better.

It’s sizing better.

Pros don’t gamble.

They compound.