How to Win on Polymarket: Bitcoin UP/DOWN Strategies That Actually Work

polymarket bitcoin up down predictions

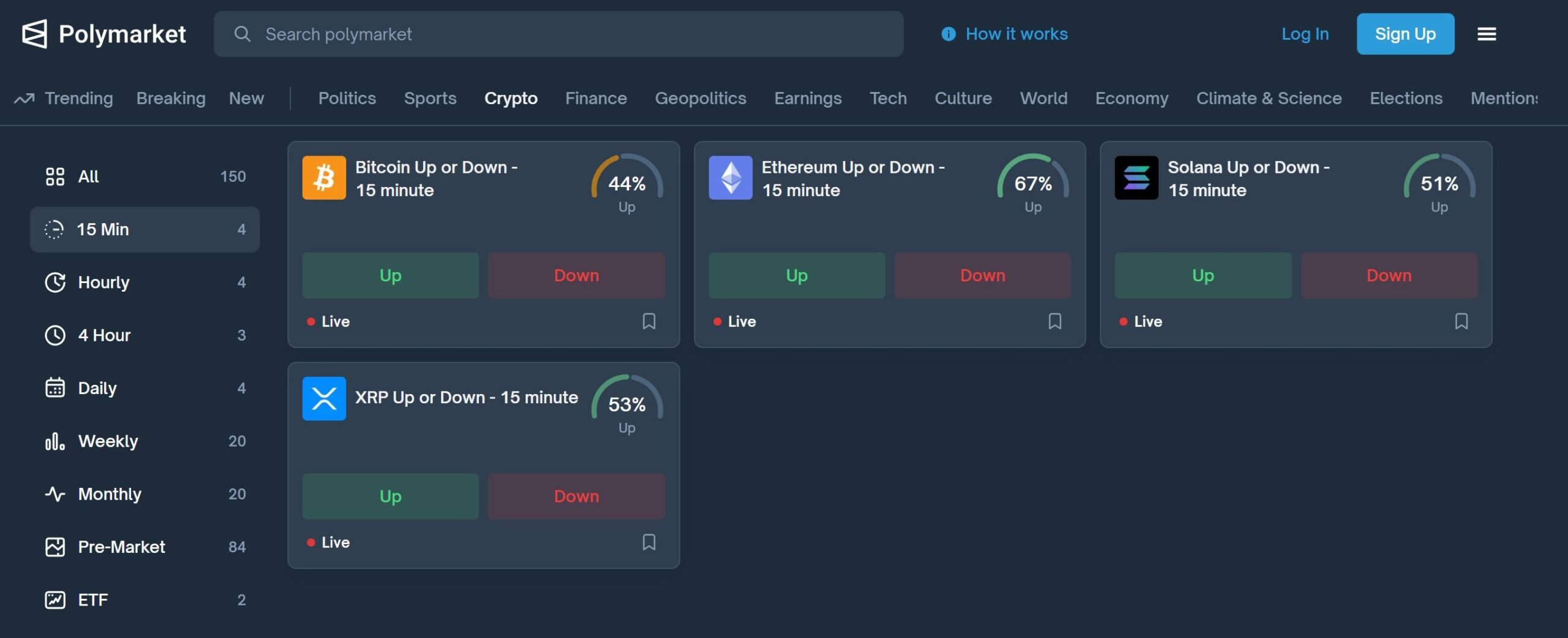

Polymarket’s Bitcoin UP/DOWN markets look simple.

Pick UP or DOWN, wait 15 minutes, get paid.

And yet…

most traders lose.

Not because Polymarket is rigged.

Not because Bitcoin is random.

But because most people approach 15-minute markets the wrong way.

This guide explains what actually works — without charts, without technical analysis, and without pretending you’re a Wall Street quant.

If you trade Bitcoin UP/DOWN markets on Polymarket (or want to), this is for you.

Why Most Polymarket Traders Lose (Even When They’re “Right”)

Here’s the uncomfortable truth:

You can be right about Bitcoin and still lose on Polymarket.

Why?

Because short-term markets don’t care about long-term opinions.

Common losing behaviors:

-

Entering immediately at the start of the 15-minute window

-

Chasing a move that already happened

-

Betting based on “feelings” or Twitter sentiment

-

Thinking 15 minutes = mini version of spot trading

In reality, 15-minute markets have their own rules.

And once you understand them, Polymarket becomes much easier.

The Reality of 15-Minute Bitcoin Markets

Short-term markets are driven by:

-

Overreactions

-

Forced entries

-

Liquidity hunting

-

Emotion, not logic

In the first few minutes, price often moves too far, too fast.

That creates opportunity — if you know how to wait.

The Biggest Mistake: Entering Too Early

Most traders do this:

-

New 15-minute market opens

-

Price moves quickly up or down

-

Trader panics → enters immediately

-

Price stalls or reverses

-

Loss

This mistake alone wipes out most Polymarket accounts.

Timing matters more than direction.

Why Waiting a Few Minutes Changes Everything

Something interesting happens in Bitcoin markets:

The first 5 minutes often determine whether the next 10 minutes will continue… or reverse.

Early moves are frequently:

-

Stop hunts

-

Emotional reactions

-

Position clean-ups

After that, price either:

-

Continues with momentum, or

-

Snaps back toward the starting price

This behavior repeats constantly — and it’s not random.

The Bounce-Back Effect (Simple, Powerful, Overlooked)

One of the most reliable short-term behaviors in Bitcoin is what traders call a bounce-back.

It works like this:

-

Price drops quickly at the start

-

Sellers get exhausted

-

Price drifts back up

-

Panic sellers get trapped

Same logic applies in reverse for UP moves.

This is why chasing the first move is usually a mistake — and waiting for confirmation often pays.

Why UP/DOWN Markets Are Easier Than Spot Trading

UP/DOWN markets remove a lot of complexity:

-

No stop-loss guessing

-

No leverage management

-

No liquidation fear

All you care about is:

Will price end higher or lower than where it started?

That’s it.

This simplicity is exactly why pattern-based approaches and probabilities work so well here.

Why “Gut Feeling” Fails in Short Timeframes

Human intuition is terrible at:

-

Processing fast data

-

Ignoring recent price moves

-

Being consistent

That’s why traders:

-

Overtrade

-

Change bias mid-market

-

Revenge trade

Short-term markets punish emotion.

What works better is consistent decision rules — the same ones, every time.

Where AI Actually Helps (Without Overcomplicating It)

You don’t need to understand how AI works.

What matters is what it’s good at:

-

Watching thousands of past 15-minute windows

-

Seeing which early behaviors matter

-

Ignoring hype, fear, and noise

-

Producing probabilities, not opinions

AI doesn’t “predict the future”.

It recognizes when odds are skewed.

That’s exactly what UP/DOWN markets care about.

How Successful Polymarket Traders Think Differently

Winning traders don’t ask:

“Where will Bitcoin go?”

They ask:

“Is this setup statistically better than random?”

They:

-

Don’t trade every market

-

Wait for confirmation

-

Avoid emotional entries

-

Think in probabilities, not certainty

Winning isn’t about being right every time — it’s about having better odds over many trades.

How to Apply This Without Overthinking

If you want to improve on Polymarket:

-

Stop entering immediately

-

Stop chasing large candles

-

Pay attention to early movement behavior

-

Trade fewer markets, but better ones

Or use tools designed specifically for this type of decision-making.

Use Probabilities, Not Hope

Short-term markets reward traders who:

-

Respect timing

-

Understand overreactions

-

Stick to rules

-

Use probabilities instead of gut feeling

That’s exactly why 15-minute UP/DOWN predictions are becoming popular among Polymarket traders.

Want an Edge on 15-Minute Bitcoin Markets?

Crypticorn provides real-time AI-based UP/DOWN probabilities designed specifically for short-term markets.

No charts.

No guesswork.

No emotions.

Just probabilities you can act on.

👉 Try Crypticorn’s 15-Minute Bitcoin Predictions and trade Polymarket with an edge.