How AI Helps Traders Beat Polymarket Odds

(Without Overthinking or Staring at Charts)

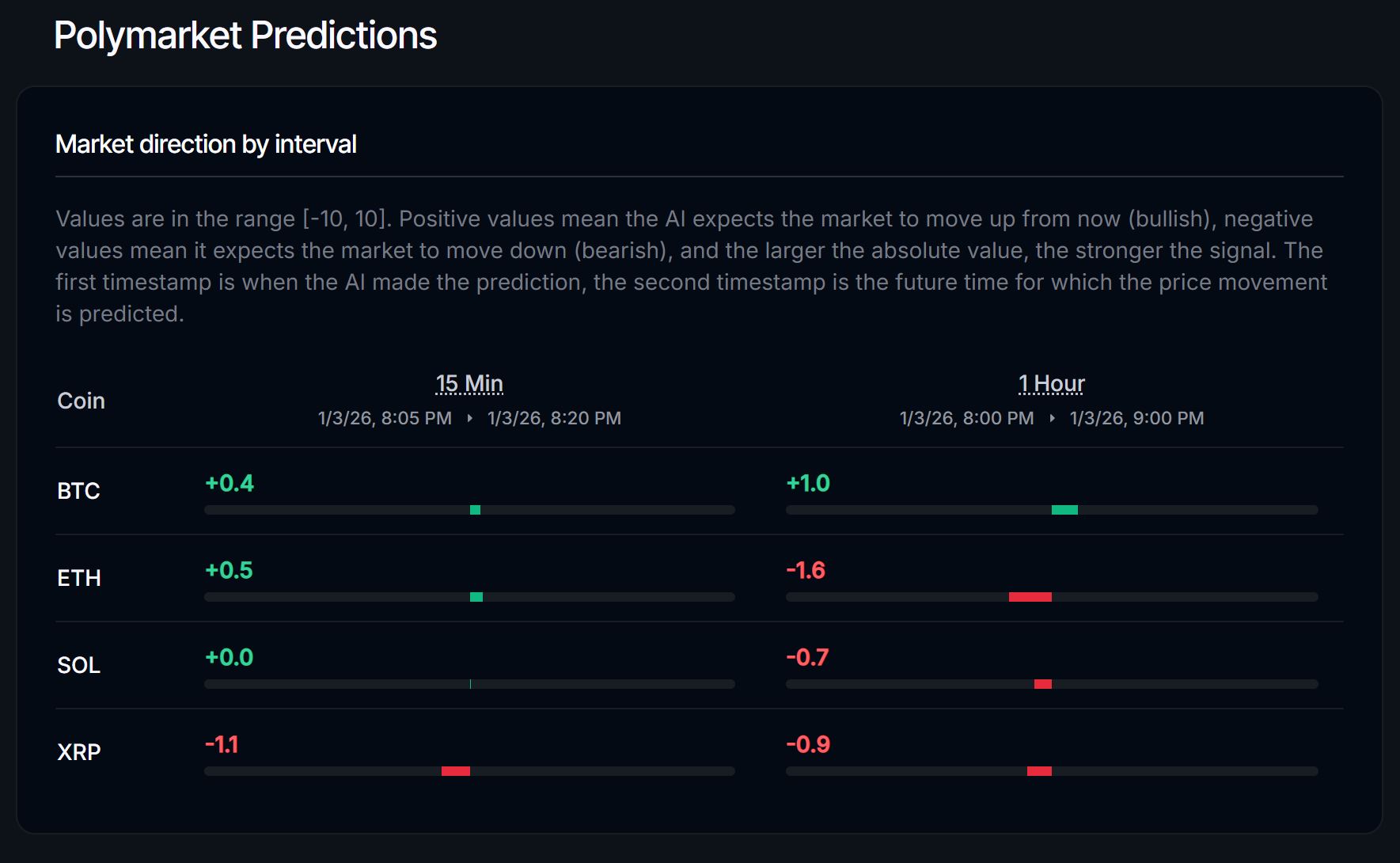

Polymarket AI Tool: Predict the direction strength

I’ll be honest.

When I first heard people talking about AI predictions for trading, I rolled my eyes.

I imagined:

-

overcomplicated dashboards

-

fake performance claims

-

lots of buzzwords

-

zero real value

But after trading Polymarket long enough, I realized something:

Short-term markets don’t reward intelligence — they reward consistency.

And consistency is exactly where humans struggle.

Why Humans Are Bad at 15-Minute Decisions

On Polymarket, especially in 15-minute markets, decisions have to be made fast.

That’s a problem for humans.

We:

-

chase recent moves

-

panic when price moves fast

-

hesitate when we should act

-

act when we should wait

Even experienced traders aren’t immune.

I’ve made the same mistakes hundreds of times.

What AI Is Actually Good At (No Hype)

AI isn’t magic.

It doesn’t “know” the future.

What it’s good at is much simpler:

-

looking at thousands of past situations

-

recognizing repeating behavior

-

ignoring emotions

-

staying consistent

That’s it.

And in short-term markets, that’s powerful.

Why AI Fits Polymarket So Well

Polymarket UP/DOWN markets are simple:

-

up or down

-

fixed time

-

no trade management

This makes them perfect for probability-based decisions.

AI doesn’t need to predict an exact price.

It just needs to answer:

Is UP or DOWN more likely right now?

That’s exactly how Polymarket works.

How I Actually Use AI in My Polymarket Trading

I don’t follow AI predictions blindly.

I use them as a filter.

Before entering a trade, I ask:

-

Does this align with price behavior?

-

Are probabilities clearly tilted?

-

Or is this just noise?

If AI says probabilities are close to 50/50, I skip the trade.

Skipping trades has saved me more money than forcing them.

The Biggest Misconception About AI Trading

Most people think AI is about:

“Winning more trades”

In reality, its biggest value is:

“Avoiding bad trades”

And on Polymarket, avoiding bad trades is huge.

Bad timing = instant loss.

Why AI Beats Gut Feeling (Especially for Degens)

Gut feeling:

-

changes constantly

-

depends on mood

-

reacts to noise

AI:

-

applies the same logic every time

-

doesn’t chase candles

-

doesn’t get bored

-

doesn’t revenge trade

That consistency compounds over time.

Where Most Traders Use AI the Wrong Way

They:

-

expect certainty

-

follow signals blindly

-

overtrade because “AI said so”

That’s not how to use it.

AI works best when you:

-

stay selective

-

combine it with patience

-

respect timing

It’s a guide, not a dictator.

Why I Trust Probabilities More Than Opinions Now

Polymarket is literally a probability market.

So it makes sense to trade it with probability-based tools, not opinions or emotions.

That mindset shift changed how I trade completely.

Why I Use Crypticorn for Polymarket

Crypticorn gives real-time 15-minute Bitcoin UP/DOWN probabilities.

No charts.

No hype.

No confusion.

I use it to:

-

avoid trades with no edge

-

confirm when timing makes sense

-

stay disciplined

It doesn’t guarantee wins.

Nothing does.

But it helps me trade smarter.

👉 If you trade Polymarket regularly, it’s worth trying.

Read This Next

If you haven’t yet, this is the foundation:

👉 How to Win on Polymarket: Bitcoin UP/DOWN Strategies That Actually Work

Everything connects back to that guide.