The 5-Minute Mistake That Kills Polymarket Trades

(I Learned This the Expensive Way)

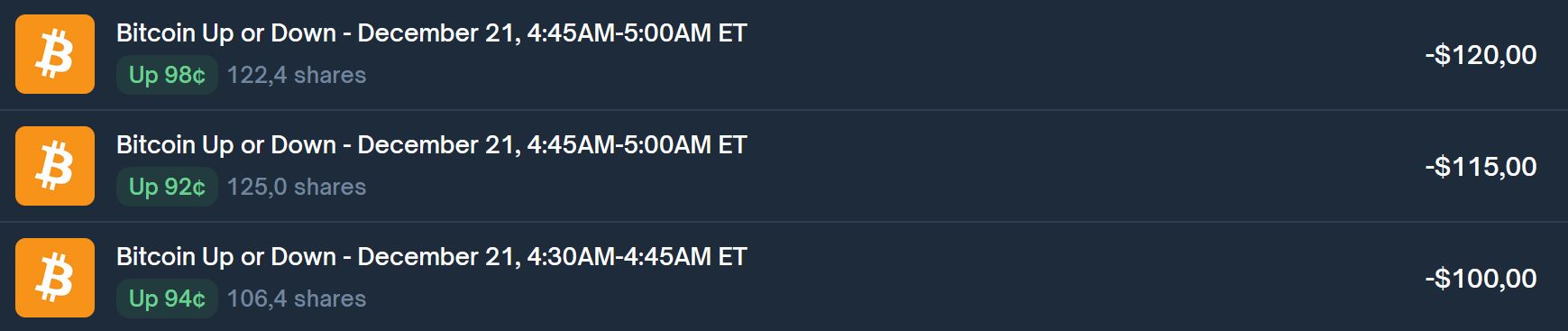

Polymarket costly mistakes and losses and how to avoid them

If I had to name one mistake that costs Polymarket traders the most money, it’s this:

Entering too early.

Not bad direction.

Not bad odds.

Bad timing.

And almost always, it happens in the first 5 minutes.

I Used to Enter Immediately — And Pay for It

When I started trading Polymarket 15-minute markets, my logic was simple:

-

Market opens

-

Price moves

-

I act fast

-

I feel smart

And then… I lose.

Over and over again.

At some point I realized:

I wasn’t losing because I was wrong —

I was losing because I was early.

What Actually Happens in the First 5 Minutes

The first few minutes of a 15-minute market are chaotic.

You have:

-

traders rushing in

-

bots repositioning

-

stop hunts

-

emotional reactions

Price moves fast, but not clean.

Most of the time, those early moves are not the real direction — they’re the shakeout.

Why Early Entries Feel So Tempting

Early entries feel good because:

-

you feel proactive

-

you’re “first”

-

the move looks strong

-

odds shift quickly

But feeling early doesn’t mean being right.

In short markets, early often means exposed.

The Pattern I See Over and Over Again

This repeats constantly:

-

Market opens

-

Price drops quickly

-

Everyone panics

-

DOWN odds spike

-

Late sellers pile in

-

Price stabilizes

-

Price drifts back up

Same logic applies in reverse.

This is the bounce-back effect — and it catches degens every day.

Why 5 Minutes Changes Everything

Those first minutes reveal:

-

whether a move is emotional or controlled

-

whether traders are chasing

-

whether price stretched too far

By waiting:

-

emotions cool down

-

fake moves expose themselves

-

better entries appear

Patience creates clarity.

Why Most Traders Never Learn This

Because:

-

waiting feels boring

-

missing a trade feels painful

-

doing nothing feels wrong

So traders smash buttons instead.

Polymarket doesn’t reward action.

It rewards good action.

How I Trade 15-Minute Markets Now

I rarely enter immediately.

I:

-

watch the first few candles

-

see how price reacts

-

pay attention to speed and distance

-

avoid obvious moves

Sometimes I don’t trade at all.

Skipping bad trades improved my results more than finding good ones.

This Is Where Probabilities Matter Most

You don’t need predictions before the market opens.

You need guidance after price shows its hand.

That’s why probability-based tools work best after the first few minutes, not before.

They help answer:

Is this move sustainable — or overdone?

Why Early Entries Feel Smart (But Aren’t)

Early entries give you:

-

bragging rights

-

“I called it” stories

Late entries give you:

-

losses

-

frustration

-

confusion

Winning traders trade probability — not ego.

My Honest Rule for Polymarket Traders

If you remember only one thing, remember this:

If a 15-minute trade feels urgent, it’s probably bad.

Good trades don’t rush you.

How Crypticorn Fits Into This

Crypticorn’s 15-minute UP/DOWN probabilities are designed for exactly this moment — after early chaos, when behavior matters more than hype.

It helps me decide:

-

whether to engage

-

which side has better odds

-

or whether to stay out

I don’t use it blindly.

I use it to avoid dumb trades.

👉 If timing is your weakness on Polymarket, this helps a lot.

Read This Next

If you haven’t read the main guide yet, start here:

👉 How to Win on Polymarket: Bitcoin UP/DOWN Strategies That Actually Work

Everything you need builds on that.