15-Minute vs 1-Hour Crypto Markets on Polymarket

(Which One Actually Pays?)

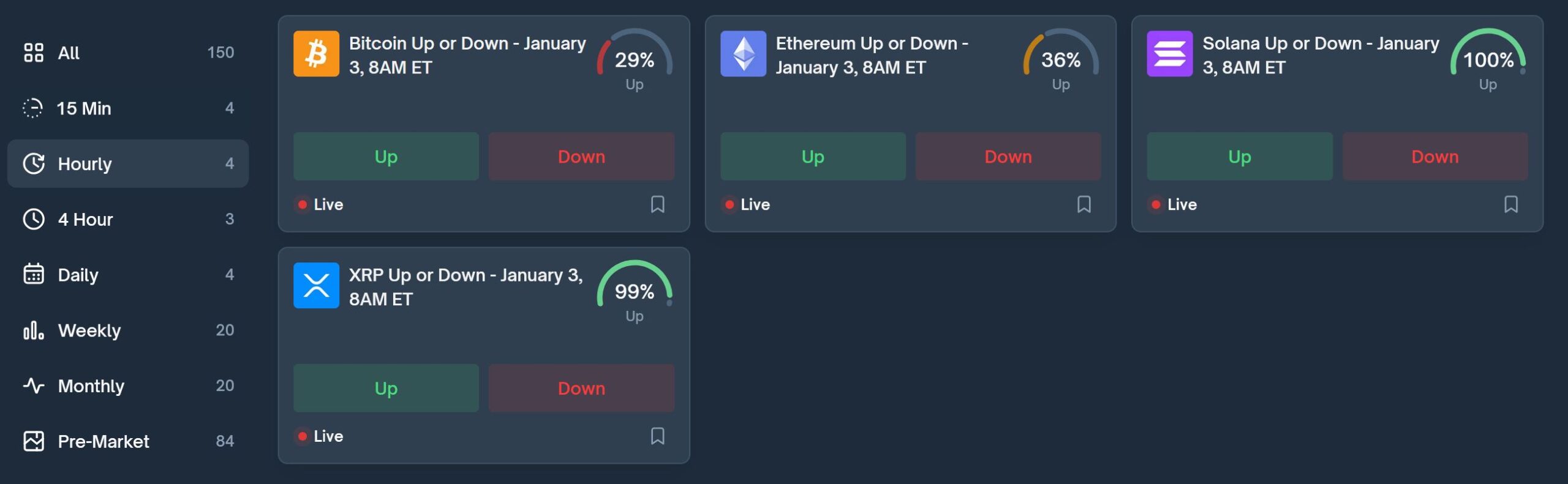

Polymarket’s crypto market short-term predictions: 15min vs. 1h – differences

This is one of the first questions I had when I started trading Polymarket seriously:

Should I trade the 15-minute Bitcoin markets… or the 1-hour ones?

At first, I assumed 1-hour markets were “safer”.

Longer timeframe. More time to be right. Less stress.

That assumption cost me money.

After trading both for a long time, here’s the honest truth:

They behave very differently — and most people choose the wrong one for their mindset.

Why Most Traders Start With 1-Hour Markets

The logic seems sound:

-

More time = more room for price to move

-

Less noise than 15-minute markets

-

Feels more “strategic”

I get it. I started there too.

But here’s the problem.

The Hidden Trap in 1-Hour Polymarket Markets

1-hour markets look calmer, but they hide different dangers:

-

You sit in the trade longer

-

You overthink more

-

You react to every small move

-

You change your bias mid-trade

I can’t count how many times I:

-

entered confidently

-

watched price move against me

-

panicked

-

exited early

-

watched price go my way later

Longer markets don’t remove emotion — they stretch it out.

Why 15-Minute Markets Feel Harder (But Often Aren’t)

15-minute markets feel intense.

Everything happens fast:

-

entries

-

moves

-

outcomes

And yes, they punish bad timing.

But that’s also their advantage.

Short markets expose mistakes quickly.

There’s less time to doubt yourself.

Less time to self-sabotage.

Less time to interfere with your own trade.

You either had a good setup — or you didn’t.

Behavior Matters More in Short Markets

One big reason I prefer 15-minute markets:

Price behavior is cleaner.

In short windows:

-

moves happen for a reason

-

overreactions stand out

-

fakeouts resolve quickly

You don’t need to predict where Bitcoin will be in an hour.

You only need to understand what tends to happen next.

That’s a much easier problem.

Where Most Degens Get 15-Minute Markets Wrong

They treat them like faster versions of 1-hour trades.

They:

-

enter immediately

-

chase early moves

-

overtrade

-

react emotionally

15-minute markets aren’t about speed.

They’re about waiting.

Waiting for:

-

early chaos to settle

-

price to show its hand

-

emotions to peak

Comparing the Two (From Experience)

Here’s how I see it now:

1-Hour Markets

-

More room to second-guess

-

Harder to stay disciplined

-

Easier to sabotage yourself

15-Minute Markets

-

Brutal if you rush

-

Clean if you wait

-

Less emotional drag

Neither is “better” objectively — but most traders are not built for long-duration stress.

Why I Focus on 15-Minute Polymarket Markets

Personally, I trade 15-minute markets because:

-

I like fast resolution

-

I can spot bad setups quickly

-

I don’t want to babysit trades

-

I prefer probability-based decisions

Short markets reward:

-

patience

-

selectivity

-

consistency

Not excitement.

Which One Should You Trade?

Ask yourself honestly:

-

Do you overthink trades?

-

Do you second-guess yourself?

-

Do you change your bias mid-market?

If yes, 1-hour markets will punish you.

15-minute markets force discipline — whether you like it or not.

The Real Edge Isn’t the Timeframe

The edge isn’t 15m vs 1h.

It’s:

-

knowing when not to trade

-

understanding early price behavior

-

using probabilities instead of feelings

Timeframe just amplifies your habits.

How I Trade 15-Minute Markets Now

I don’t trade every market.

I:

-

wait a few minutes

-

ignore obvious moves

-

skip crowded setups

-

think in probabilities

That alone improved my results more than switching timeframes ever did.

A Tool That Actually Fits Short Markets

Short markets don’t give you time to analyze.

You either have clarity — or you don’t.

That’s why I like real-time probability-based predictions for 15-minute Bitcoin markets.

Crypticorn gives exactly that — without noise or overcomplication.

I treat it as a filter, not gospel.

But it keeps me out of dumb trades.

👉 If you’re focused on Polymarket 15-minute trades, it’s worth checking out.

Read This Next

If you haven’t already, start here:

👉 How to Win on Polymarket: Bitcoin UP/DOWN Strategies That Actually Work

Everything else builds on that.